How do I enter my Tax ID or VAT number at checkout OptimizePress Docs

It is made up of 9 numbers. The first 8 numbers do not have any meaning and the 9th digit is only used to double check the logarithm in the first numbers. More info (in French) can be found in this webpage of the French authorities Siret Number SIRET numbers are made up of 14 numbers.

What is a VAT?

Used to identify tax status of the customer Help to identify the place of taxation Mentioned on invoices (except simplified invoices in certain EU countries) Sometimes also known as a VAT registration number, this is the unique number that identifies a taxable person (business) or non-taxable legal entity that is registered for VAT.

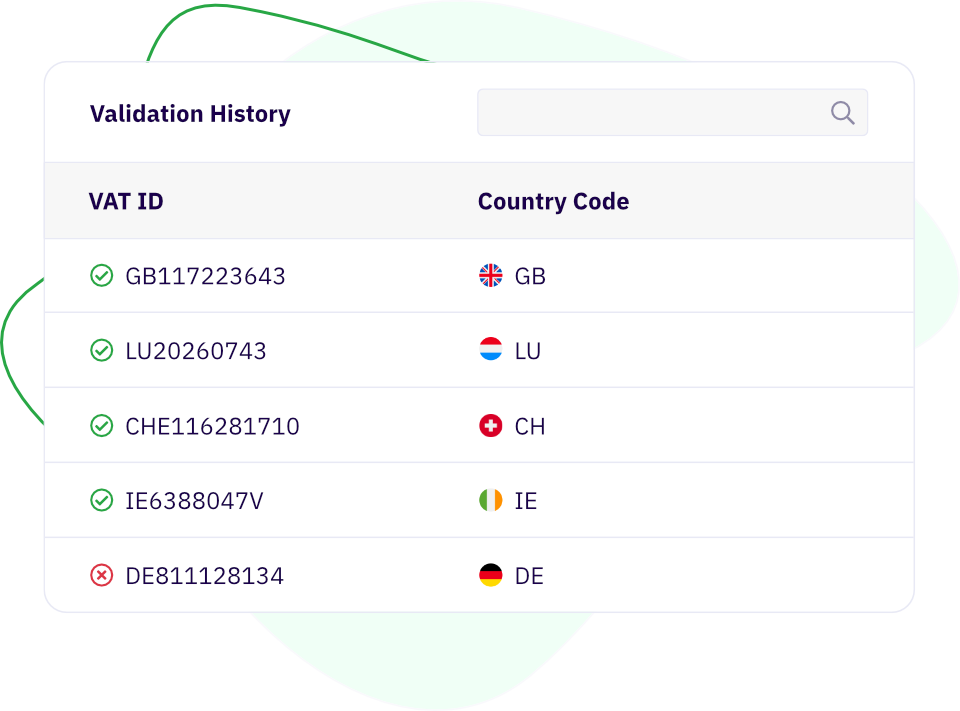

Brexit UK VAT number validation

1. Look at an invoice or insurance document to find a VAT number. If a company uses VAT taxes in their prices, they'll usually list the company's VAT number somewhere on the document. Check for VAT numbers near the letterhead on top of the page or by the information at the bottom.

Partita IVA Inghilterra (VAT number) cos'è? Come e quando aprirla?

Che cos'è il VAT identification number? Il VAT identification number, fa parte del sistema VIES per lo scambio di informazioni relative all'IVA e serve per il controllo e verifica validità del numero di Partita IVA di imprese e professionisti di tutta l'Unione europea. Attraverso il VAT, pertanto, tutti i cittadini possono verificare online.

VAT Number Check API for Business Customers Vatstack

A VAT number is an identification number for all VAT purposes in the country where such number was issued. Very often the VAT number will be the only tax identification number in the relevant country. However, sometimes tax authorities may issue two numbers: a local tax number for local transactions and communications with the tax authorities.

Value Added Tax (VAT) Information & FAQ Nexcess

Taxation Value added tax (VAT) Intra-Community VAT Number This page has been automatically translated. Please refer to the page in French if needed. EN - English Intra-Community VAT.

VAT identification number cos’è come funziona, quando, a cosa serve

The VAT tax number (turnover tax number) consists of either the Legal Entities and Partnerships Information Number (RSIN), or your Citizen Service Number (BSN), followed by a code of 3 characters between B01 and B99. It looks like this example: 123456789B01. This is the number you use in all correspondence with the Tax Administration.

Cos'è il VAT NUMBER e come ottenerlo?

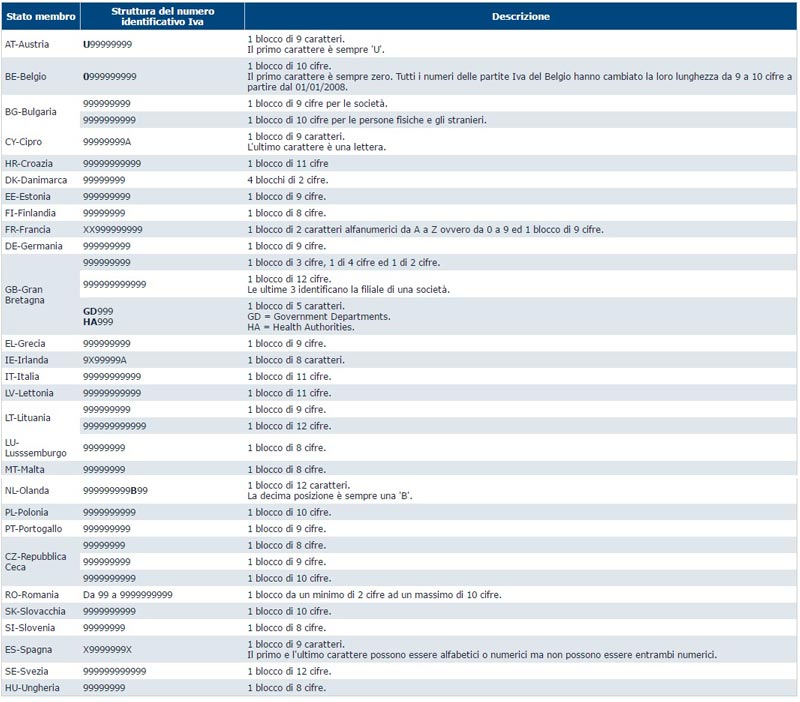

Dunque, un numero di partita IVA è un numero di identificazione per le società con partita IVA. Si tratta di un codice univoco, assegnato a ogni azienda registrata per partita IVA. Solo i Paesi con un sistema IVA, ovviamente, richiedono alle aziende di avere un numero di partita IVA, ovvero un VAT Number. Un VAT Number inizia con un codice.

La fattura commerciale cos'è e come si compila Sendcloud

Che cos'è il VAT number e come si utilizza per le operazioni intracomunitarie L'acronimo VAT deriva dall'espressione inglese Value Added Tax. Chi ha dimestichezza con la lingua inglese avrà già capito che essa sta per Imposta sul Valore Aggiunto. Pertanto, la VAT altro non è che la nostra IVA. Che cos'è il VAT identification number

จดทะเบียนภาษีมูลค่าเพิ่ม จด VAT สำนักงานบัญชี พีทูพี

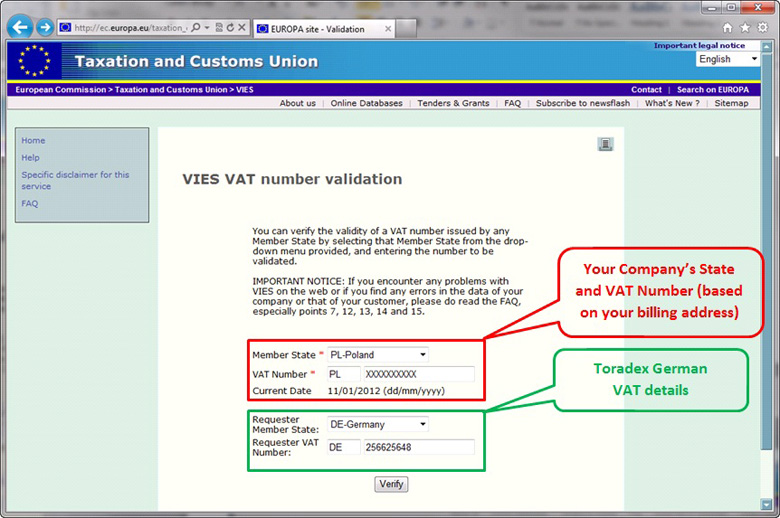

What is VIES? VIES (VAT Information Exchange System) is a search engine (not a database) owned by the European Commission. The data is retrieved from national VAT databases when a search is made from the VIES tool.

1.7.2.4 IDNUMBER vs. VATnumber General topics Forums

What is an intra-Community VAT number? Are concerned all European companies subject to VAT in a Member State which, as part of its trade exchanges with a company located in another Member State, has a tax identification number called intra-Community VAT number.

VAT Number cos’è, cosa significa, cosa c’entra con la partita IVA

Wrapping up VAT codes explained Simply put, VAT codes identify how much VAT should be paid on the purchases of services and goods from your business. The codes are usually composed of a percentage and one or two letters but may appear differently depending on whether it's used on the sales form or purchase form.

Get the VAT number for your business in any EU country

Some countries even have a different TIN structure for different categories of individuals (e.g. nationals and foreign residents). European TIN Portal In order to facilitate the work of all stakeholders, the European Commission has launched a cooperative project whereby information about TINs for natural persons that Member States choose to.

Toradex How to validate the EUVAT number?

Quando parliamo di VAT Number facciamo riferimento ad un codice numerico inerente alla partita IVA. Nello specifico, col VAT Number parliamo di strumento elettronico utile a verificare il numero della partita IVA, di tutte le imprese registrate all'interno della comunità europea.

Getting it right Crowe UK

Latest update: 22/09/2021 Vat - Value added tax - or Iva - Imposta sul Valore Aggiunto, in Italian language, is a consumption tax that applies to the supply of goods and services carried out in Italy by entrepreneurs, professionals, or artists and on importations carried out by anyone.

Cos'è e come verificare velocemente il VAT number? Gestionale.co

Vies on-the-Web - European Commission. This site uses cookies to offer you a better browsing experience. Find out more on how we use cookies.